FAQs

Bond Election

-

It is an election where the city seeks permission from voters to authorize the future issuance of debt to pay for designated capital purchases and improvement projects.

-

The Town is finalizing an Asset Management Plan that provides a tool to evaluate the Town's assets in order to determine criteria and timelines for equipment and facility replacement. The Town has also completed an ADA transition plan that has identified millions of dollars in improvements required to make Town infrastructure and facilities ADA compliant. With all that information in hand, Council believed it was the right time to consider another bond election.

-

The bonds will be paid for from ad valorem (property) taxes.

-

Streets

- Jacobs Engineering Group developed detailed cost estimates based on:

- Current project plans, as-builts, GIS and survey information.

- Utility plans and drainage reports.

- Typical street cross sections developed based on the Town’s design standards and the Master Transportation Plan.

- Planning level cost estimates developed using costs from other recent city, county, and TxDOT construction projects.

- Soft costs were applied as a percentage of the total construction cost for administrative, engineering, legal, and construction support.

- 20% contingency was added to the cost of each project.

Parks, Buildings, Information Technology

- Consultant and contractors developed pricing for the projects.

- A 3% inflationary factor was added for each year assumed beyond 2019.

- 7% was added to HVAC to account for potential tariffs.

- A 15% project contingency was included in the cost estimates.

- Smart City initiatives added a 5% inflationary factor and 10% contingency to all costs.

- Jacobs Engineering Group developed detailed cost estimates based on:

-

If all five bond propositions were approved and the bonds were issued as currently projected, over a five year period from 2020-2024, the anticipated tax rate impact to the homeowner is currently estimated to be a potential tax increase of $0.103100 (just over 10 cents per $100 of assessed value) based on conservative interest rates and future projections of the Town’s tax base. However, the actual tax rate impact will be determined by the timing of when the bonds are sold, the prevailing interest rates, and the Town’s property values at the time of sale.

-

The Town is permitted to expend bond proceeds only for the purposes described in the corresponding proposition.

-

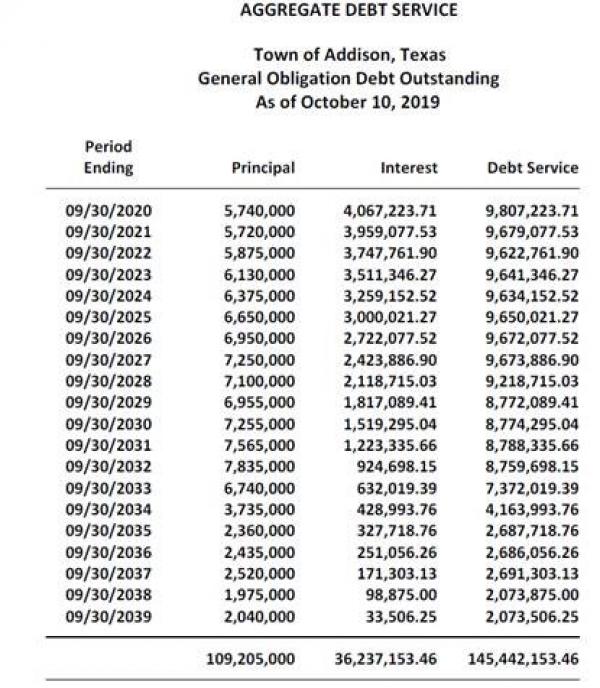

Addison's total debt outstanding is $145,442,153.46 which consists of $109,205,00 in principal and $36,237,153.46 in interest, including the 2019 Certificates of Obligation, as of the beginning of Fiscal Year 2020.

-

Addison currently has $42,250,000 in committed projects.

- Midway Road: $11,500,000 – Future CO/2012 GO (August 2020)

- Midway Road: $11,500,000 – 2012 GO (August 2021)

- Arts Land/Parking: $3,000,000 – 2012 GO (June 2022)

- Addison Grove: $3,250,000 – Future CO (May 2023)

- Vitruvian Park: $6,500,000 – Future CO/2012 GO (August 2025)

- Vitruvian Park: $6,500,000 – 2012 GO (August 2030)

Total "Committed" Projects: $42,250,000

CO – Certificates of Obligation

2012 GO – General Obligation bonds approved in the 2012 bond election, followed by anticipated sale date. -

The role of the Committee is:

- To assess and review information related to proposed future capital projects;

- To provide input in developing a final list of projects;

- To make a recommendation to Council concerning whether a bond election should be called and, if so, what projects should be included

- To serve as community advocates for the bond program election, if Council decides to call an election

-

At its November 27, 2018 meeting, the Addison City Council discussed the possibility of a November 2019 bond program. As part of that program, Council formed a Community Bond Advisory Committee to help prioritize projects. The projects being considered impact Addison's roads, parks, and municipal buildings. Twenty-eight people were appointed to the Committee at the December 11 City Council meeting. This group began meeting on January 30, 2019 and presented their recommendations to the City Council on June 11, 2019.

-

Last day to register to vote: October 7, 2019

Early Voting: October 21 – November 1

Election Day: Tuesday, November 5

Photo ID is required to vote in Texas. Find out more at www.votetexas.gov.

-

Standard and Poor's and Moody's have reaffirmed Addison's top bond ratings. Addison is one of only eleven cities in Texas with AAA bond ratings from both Moody’s and S&P.

-

Addison’s Master Transportation Plan was revised and the new plan adopted by the City Council in December 2016. The 2016 plan updated the requirements for the width of streets and medians throughout Town, as well as the location and scale of the pedestrian amenities, including sidewalks and enhanced landscaping.

-

The Pavement Condition Index rates the condition of the surface of a road network by measuring the type, extent and severity of pavement surface distresses (typically cracks and rutting) and the smoothness and ride comfort of the road. Roads are given a rating of 0 - 100:

85 - 100: Good

70 - 85: Satisfactory

55 - 70: Fair

50 - 55: Poor

25 - 40: Very Poor

10 - 25: Serious

Less than 10: failed -

The Town is in the process of finalizing an Asset Management Plan. For more than 18 months, Addison has worked to identify and assess the Town’s nearly 60,000 physical assets that have a replacement cost of more than $950 billion. Assets include the Town's buildings, parks, landscape areas, water and wastewater facilities, streets, bridges, sidewalks, traffic signals and signs, streetlights, fleet, airport, and storm water systems. Each system was assigned a physical health score that reflects its condition and the total replacement cost. Factored into this Asset Management Risk Score is the impact if the asset fails before being replace. Under this scoring system, the cost of failure for a busy street is higher than that of a less-traveled side street.

Green: Excellent

Yellow: Good/Fair

Red: Failed/Critical